China is a Big Country

by Gene Wood

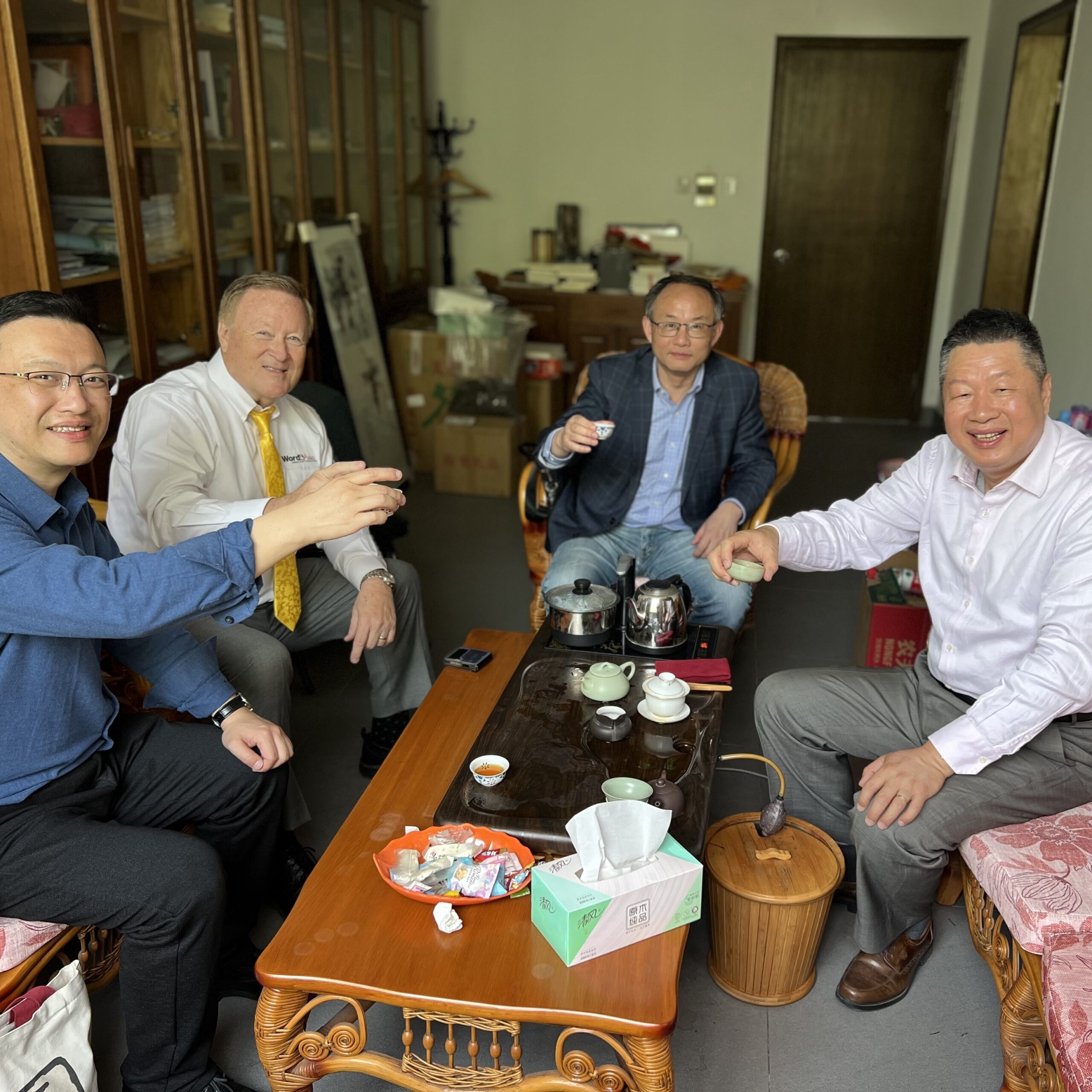

Tea time with Seminary President Rev. Chen of Nanjing Union Theological Seminary

Returning from our most recent trip to China, after 3 years hiatus due to Covid, I have been asked, “Well, what do you think?” “What are your takeaways?” “What’s the difference before and after Covid?”

Difficult questions to even begin answering in an accurate and informative manner. Our visit only covered three major cities: Shanghai, Beijing, and Nanjing. While we had 3 to 4 meetings per day, that still means there were about 1.4B people we did not talk to. Our targeted focus was upon visiting those who are connected to groups our W4A clients are interested in serving. That means we did not have any contact with leaders who deal with 95% of Chinese activity. W4A is a consulting firm which helps quality nonprofits from the West achieve their objectives in China, following the policies and regulations of the PRC.

When I first began my journey in China in 1998, I would ask my mentors “what is the truth about China?” I asked it in dozens of variant ways, but almost all my questions were searching for a general summary of China I could easily wrap my head around. The most helpful response I received was from an elderly Chinese man. He said simply “China is a big country. All the good things you hear are probably true. Some of the bad things you hear may be true also.” China is now the second largest nation. Innumerable segments of society in urban, rural and countryside, mixed with multiple ethnic groups, various economic and educational strata, makes it impossible to reach a singular view of anything after two weeks, two months or years. China is a BIG country. Like the three blind men who felt the elephant, we only feel one small part of China on a given visit.

Meeting with National SARA / United Front 11 & 12.

Let me put it in a perspective Westerners can understand. If a first-time guest from China was visiting our country and asked, “Are your politicians’ good people?” How would you answer them? If they asked, “Are you policeman good people?” How would you respond? Truthful and factual responses are seldom simple. Generalities are at best biased attempts to answer complex questions.

We did not enter China with economic, business, or political agendas. These are not the arena W4A works in. So, I have limited value to offer these conversations. What I can tell you is that we received VIP treatment from all we met with, some old friends and others, new friends. Everyone we met from national leadership to the Cities, welcomed us back to China and expressed hope for continued relationship and for a healthy-growing working engagement. We encountered famous Chinese hospitality. I believe if you enter China with a desire for friendship and a willingness to listen more than instruct, you will find the same as we did. In at least two national offices, W4A was the first American group to visit since Covid. I hope many more will follow.

Gift giving, an important part of the culture.

Are there changes? Of course. My singular encouragement to those returning is to ask questions more than talk. Avoid political conversation unless of course that is your job. Be humble. Build bridges. Be willing to alter your course if the new China requires it. For those wishing a good fly-over of the China geo-political position, a visit to the National Museum and Chinese Gift Museum in Beijing will be educational.

My sentiment is, now is not the time to pull away from China. To paraphrase Confucius; If your goals seem unachievable, change your strategies and not your goal.

Your Fellow Traveler,

Gene