China Sector Growth

by Sarai Fetty

China’s Fastest Growing Economic Sector? You May Be Surprised!

If you were to guess what the number one growth sector in the Chinese economy will be in the next few years, which one would you pick?

If your answer is China’s quickly growing film industry, you’re correct! In fact, in 2020, China’s total box office receipts it the #1 film market in the world, with an equivalent of $2.7 billion in sales, outselling US movie theater revenues ($2.3 billion) 17.4%, in a year when US industry revenues were down 80% due to theaters being closed due to Covid-19. The market research firm, Ibis, projects 224% growth in Chinese movie theater ticket sales in 2022 over 2021.

Needless to say, China’s growing prominence in the industry is a cause for concern for the US movie production companies who, for the entire history of commercial film, have led world film revenues.

So, what’s going on? Well, it’s true that it takes money to make money and in recent years non-box office returns have provided the capital needed to fuel the continued development of

China’s film industry. For instance, there has been steady expansion of movies into second, third and fourth-tier Chinese cities, where tickets are sold at lower prices to match the difference in average household incomes. It also doesn’t hurt that China’s population is about four times the size of our own.

Another important factor is the increased use of internet and “big data” throughout the entire Chinese film ecosystem; this includes IP, production, marketing and promotion, distribution, and ticket sales. One example is the rapid rise of internet film companies (like Netflix); Tencent (producer of internet-related products and services) Pictures and Baidu (internet-related services and products and AI) Pictures are examples. The traditional Chinese film companies are in close pursuit of these recent entrants and are investing big into internet and big data technologies needed to support streaming video.

Crowd sourcing is another important source of the capital which is supporting the growth of Chinese cinema.

Recent Chinese film releases indicate that projections, like the one coming out of Ibis, are on target even with Chinese theaters running at half capacity. In February of this current year, the Chinese film industry posted its biggest month ever; 11.2 billion yuan ($1.7 billion). Of course, being a communist economy, the state has a heavy hand in controlling competition and supporting domestic producers. In the Chinese film industry, this comes in the form of ‘blackout’ periods where only Chinese films are shown. Another factor that has worked in the industry’s favor has been the absence of both direct and indirect competition. During Covid-19, there has been a lack of any American-made blockbuster films; this has given the Chinese films more ‘sunlight to grow in’. In recent blogs, we have also talked about how the shutdowns have successfully kept the Chinese in their homes or at least in their hometowns. With fewer entertainment opportunities, more people have been going to the movies, or streaming movies at home, to see domestically made films.

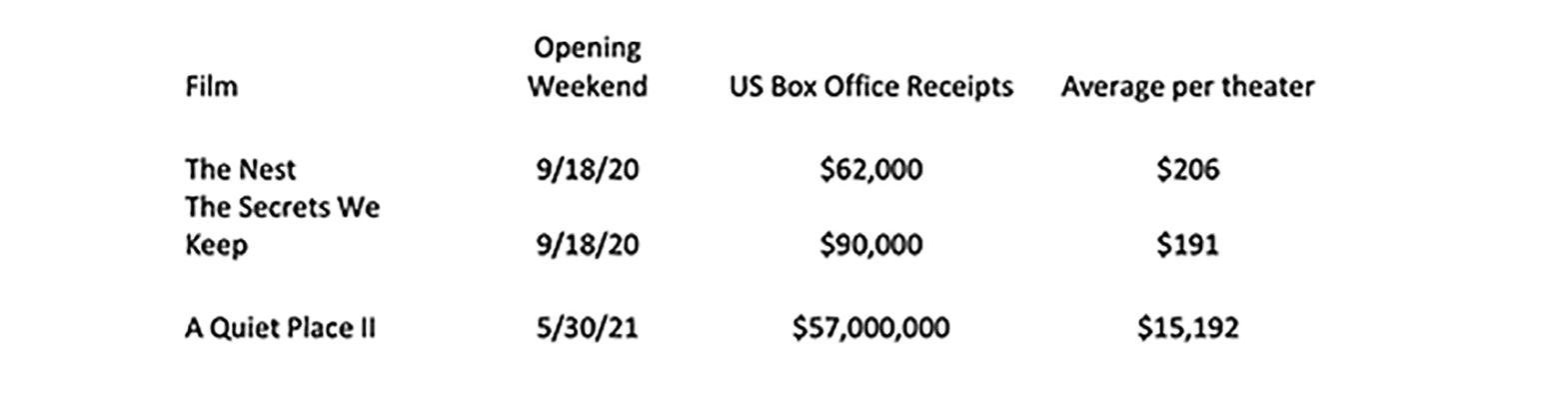

This is a stark contrast with what we have experienced at home. In the United States, few movie-goers have had the desire or courage to venture into a theater. Some of us found we enjoyed lying on our recliners and couches at home while taking in a new movie on one of the many streaming options. Others have opted to see fewer films and avoid exposure to the virus. Never the less, Memorial Day weekend film receipts did show a significant improvement, and industry people are beginning to relax a smidge. Consider this comparison:

All this is not to say that the Chinese film industry is not without its own set of challenges. One of these is the ‘K-shaped’ economic recovery, like what has occurred here. A few, giant film production companies are having massive success; the medium and small-sized companies are facing possible failure. The return of the virus, in the form of the Delta variant, has also forced theaters to either close, or operate at 25% under full capacity at all viewings. However, it is expected that this, too, is ultimately a short-term situation.

Meanwhile, the American production companies are concerned about what the continued long-term growth of China’s film industry may mean to their bottom lines. For instance, the Warner Bros. film, Godzilla vs. Kong, which opened in March of this year, earned $48.5 million in its first five days in American movie theaters. As of April 29, that take had increased to $86.6 million. The film is concurrently running on HBO Max where it continues to earn millions. In a recent interview, USC professor and film industry expert, Steven Ross said, “We still have some of the most advanced structures for filmmaking, and we also have a huge pipeline in terms of talent of writers, directors, actors, and producers, so, I still think the U.S. is in a position to lead through the good part of the next decade or two in the 21st century. Beyond that, I’m not sure.”

Other market issues also paint a questionable picture for the U.S. film industry, including the demise of the theater-mall shopping area. With more and more retail sales going e-commerce, due to Amazon and all the mini-zons that have sprouted up in recent years, the theaters do not have the traffic flowing around their businesses anymore. This pattern had been developing for years, before the pandemic and subsequent recession; that event was only the last nail in the coffin for many theaters. By the end of 2020, the number of U.S. theater screens had declined 174%. Meanwhile, as China’s economy has improved – especially in the large cities, the exact opposite trend has been occurring. Since the early 2000’s, there has been a steady increase in the number of modern malls with inexpensive restaurants, museums, shops and movie theaters. In 2019, China added 9,708 new screens and 1,453 new theaters. Even during the pandemic, the country added 300 more theaters and 5,794 more screens in 2020, which brought its nationwide total up to 75,581 screens.

As in other industries, American films also face trade restrictions when looking for distribution in China. To start, there are quotas on the number of American-made films that can run at any one time in China. Presently, that number is 34 films per year. The number increases if Chinese production companies are involved in the film. American studios also create separate edits with changes in characters, deleted parts, removal of certain symbols (such as Japanese or Taiwanese flags) in order to get past China’s censors. Peter Newman, a film professor, and head of the dual MBA/MFA Graduate program at New York University’s Tisch School of the Arts, stated, “The policies of the [Chinese] government and the entertainment business change, literally, on a weekly basis.” These changes can mean that a film which had previously been green lit for distribution is suddenly ineligible.

The industry implications of Covid-19, and China’s increasing global economic dominance are playing out in many industries. We’ve used the examples of the Chinese and American film industries because it’s something that almost all of us can relate to, given our culture’s fascination with the media. From our perspective at Word4Asia, it simply means that our role as experts on Chinese regulations, and consultants to organizations who seek to do more business with China is as important as ever, maybe more so. As always, if your organization is on the verge of an important initiative involving China, we sincerely wish you success. We’d be happy to talk with you about your plans, and possibly a role in your efforts. Feel free to contact us at gene@word4asia.com

All the Best.

Sources

https://www.ibisworld.com/china/industry-trends/fastest-growing-industries/

https://www.newsweek.com/china-box-office-hollywood-worried-1580572

https://www.wired.com/story/hope-for-american-movie-theaters/